MarketCycle Wealth REPORT

November 17, 2014 (sample)

NOTE: As our REPORT continues to evolve and improve over time, the format may appear different than the 2014 “sample” REPORT that is presented here.

IMPORTANT NOTE: The individual asset signals shown below are determined by combining the following 8 criteria:

- The trend direction of the individual asset

- Relative strength of the individual asset

- Where we are in the current market cycle

- Where we are in the longer-term secular cycle

- Central Bank activity

- Currency relative strength and trend

- Accelerated inflation data

- Accelerated economic data

♠ STOCKS

United States: BULLISH

Developed Markets (ex-U.S.): CAUTION

Japan: CAUTION

Emerging Markets: AVOID

China: AVOID

India: AVOID

Global private equity: BULLISH

- SECULAR U.S. stock outlook (effective October 1, 2011): Bull markets will be stronger than usual… buy fear & be “uncomfortably long”

- SECULAR Emerging Market stock outlook: Bear markets will be more severe than usual

CLARITY/MACRO: U.S. stocks are strong and leading in relative strength. If holding Developed Market stocks, they must be hedged into U.S. Dollars.

EXTRA: Current date of Fed Funds Futures implied (1st) rate increase: December of 2015

♠ DEBT & INCOME ASSETS

U.S. fixed-rate assets: BULLISH

U.S. floating-rate assets: BULLISH

U.S. Treasury-bond, 10 year: BULLISH

U.S. Treasury-bond, 30 year: BULLISH

U.S. fixed-rate corporate bonds: BULLISH

U.S. high-yield corporate bonds: BULLISH

Convertible bonds: BULLISH

Preferred shares: BULLISH

Emerging Market high-yield bonds: AVOID

CLARITY/MACRO: We expect floating-rate to very soon take over relative strength leadership from fixed-rate and for fixed-rate instruments to eventually become dangerous as rates rise (and they will rise). Expected first Fed interest-rate increase is December of 2015.

♠ HARD ASSETS

Gold: AVOID

Oil & energy: AVOID

Industrial metals & materials: AVOID

U.S. home price appreciation: BULLISH

- SECULAR commodity outlook (effective October 1, 2011): Commodity bear markets will be more severe than usual

CLARITY/MACRO: Commodities are in bad shape and getting worse… strong upward rallies, especially in oil, will be parabolic and short lived. The rising $US and the potential for rising interest rates in the U.S. are global drags on commodity prices. Gold normally leads the direction of oil by many months, so oil may show a further drop into the New Year. For whatever it’s worth, WTI-crude prices have very long term support at $25ish (currently at $75). China, India, Japan and Europe (and some others) are benefited by falling oil prices… Russia, Norway, Venezuela and Canada are harmed by falling oil prices. A full 70% of Russia’s economy is dependent on strong oil prices and its consumers do not benefit much from falling prices, so it is a lose/lose situation for them. Russia’s energy sector is closely intertwined with its already fragile banking system.

♠ CURRENCIES

U.S. Dollar: BULLISH

Euro: BEARISH

Yen: BEARISH

Emerging Market Currencies: AVOID

Bitcoin (high risk): BULLISH

♠ RISK ASSESSMENT:

- Calculated U.S. economic-recession probabilities within 3 months: BULLISH

- Calculated global economic-recession probabilities within 3 months: BULLISH

- Are energy costs HIGH enough to crush the economy? NO

- Are energy costs LOW enough to boost the economy? YES

- Have there been two monthly Hindenburg Double Omens, back to back? BULLISH

- S&P-500 price to momentum – divergence: BULLISH

- S&P-500 monthly RSI – divergence: BULLISH

- S&P-500 Advance/Decline price line: BULLISH

- S&P-500 Advance/Decline volume line: BULLISH

- Small-cap Advance/Decline volume line: BULLISH

- Small-cap A/D volume relative to large-cap A/D volume: BULLISH

- Micro-cap relative to large-cap – price divergence: BULLISH

- Small-cap momentum: BULLISH

- Mid-cap momentum: BULLISH

- Large-cap momentum: BULLISH

- High-yield relative to stocks – price divergence: BULLISH

- High-yield relative to Treasury-bonds – spread: BULLISH

- Stocks relative to Treasury-bonds – spread: BULLISH

- Percent of S&P-500 stocks above-to-below the 200 SMA – divergence: BULLISH

- Copper price divergence: BULLISH

- Lumber price divergence: BULLISH

- Home construction: BULLISH

- Home prices: BULLISH

- Direction of 200 Day Moving Average: BULLISH

- Cyclically Adjusted Price-to-Earnings Valuation Ratio: BULLISH

- Warren Buffett Valuation Ratio: BULLISH

- Q-Ratio Valuation Metric: BULLISH

- U.S. 3-month:10-year interest rate yield-curve: BULLISH

- U.S. 2-year:10-year interest rate yield-curve: BULLISH

- Volatility trading range: BULLISH

- U.S. Leading Economic Indicators CONTRACTION or EXPANSION: EXPANSION

- Global (ex-U.S.) Economic Contraction Risk Indicator: BULLISH

- U.S. Federal Reserve’s Survey of Professional Forecasters: BULLISH

- Likely future direction of U.S. interest rates: UP

- Un-employment trend (leads employment data): BULLISH

- Is U.S. unemployment low enough to cause wage inflation? NO

- 12 month trend of inflation: MILD INFLATION

- U.S. hyper-inflation or deflation: IN NORMAL RANGE

- U.S. CORE inflation level: BULLISH @ 1.66% (Fed goal is to maintain a 2% level.)

- ∗∗ Calculated chance of a near-term U.S. stock market CORRECTION (a multi-month 10-30% loss): below AVERAGE

- ∗∗ Calculated chance of a near-term U.S. stock market RECESSION (a year-long 20-50% loss): very LOW (U.S. recessions usually lead to global recessions, but not vice versa.)

- ∗∗ Calculated chance of a global DEPRESSION (a multi-year 50%+ loss): NONE (Depressions are always global.)

- Minor OVERSOLD Indicator most recent buy date: October 16, 2014 (prior was: November 28, 2012)

- Major OVERSOLD Indicator most recent buy date: August 5, 2011 (prior was: April 2, 2009)

- U.S. SECULAR “MY” Ratio (investing demographics): BULLISH

- U.S. SECULAR inflation or deflation: LOWFLATION

- Dow Theory: BULLISH

- U.S. Fed %-Rate to the projected GDP growth forecast: BULLISH

- U.S. employment trend: BULLISH… un-employment @ 5.8%

- U.S. manufacturing trend: BULLISH

- U.S. S&P-500 earnings trend: BULLISH

- U.S. GDP trend: BULLISH

- Sentiment: BULLISH

- U.S. stock market historical SEASONALS (updated monthly): BULLISH

- Historical annual S&P-500 gain when: growth up & Federal Reserve accommodative: 25%

CLARITY/MACRO for November 17, 2014: We remain in a strong bull market. The U.S. stock market leads in relative strength over everything else.

Please remember that we are positioning based on a long term view and some signals may trigger early and therefore seem incorrect. Short term gyrations should just be patiently tolerated; fearless patience (and limiting any mistakes to small ones) is what separates the best traders from the worst. Conditions in the United States have a strong influence on other countries, so U.S. data is of supreme importance.

When building a portfolio, please remember the following advice:

3000 year old advice: “Divide your portion to seven or even eight, for you do not know what misfortune may occur on earth.”

Warren Buffet: “Too wide diversification is only required when investors do not understand what they are doing.”

Ray Dalio: “You have to be defensive and aggressive at the same time. If you are not aggressive, you are not going to make money, and if you are not defensive, you are not going to keep the money.”

NOTE ON TRADING: All asset purchases should always be either “limit” orders or “stop-limit” orders because of the sometimes wide spread between ask & bid. The best fill times for ETFs are between 10:30 AM and 3:30 PM, U.S. EST as this is when spreads are narrower; the open should always be avoided unless using automatic “stop-limit” orders.

Burton Malkiel in A Random Walk Down Wall Street: “CAPM asserts that to get a higher than average long-run rate of return, you should just increase the beta of your portfolio. An investor can get a portfolio with a beta larger than ‘1’ either by buying high-beta stocks or by purchasing an average volatility index that is leveraged.”

ADVICE TO INVESTMENT PROFESSIONALS:

PERSPECTIVE ON CLIENT’S NEEDS: According to extensive research by Preqin, a top-level financial data provider, investors (on all levels) are seeking three things:

- Risk-adjusted returns; lower returns in exchange for less risk. They want to know that their Advisor has a method for determining high-risk periods and bear markets and that their portfolio will be adjusted accordingly.

- They want shallower draw-downs in exchange for lower returns. 67% of clients are satisfied with annual returns of between 4% & 6% and only 6% seek gains over 10% per year.

- They want diversified assets in their portfolios that are un-correlated and they do not want a 100% stock only portfolio.

What this means is that clients want risk-adjusted returns and it is only the Advisor who believes that it is his/her job to beat the S&P-500.

The money manager’s job is to make the performance line go from bottom left to upper right. It’s that simple. Once you understand that is your job description, then you have to start protecting the direction of the line.

MarketCycle would like to add that when the RISK surrounding the next big bear market hits, investors who have forgotten the lessons of 2000 and 2008 and that are now relying on Robo-Advisors and software programs and “I can do it myself” investing, will once again be seeking professional help with what remains of their money.

Graham & Dodd: “The essence of investment management is the management of risks, not the management of returns.”

What is the worst case scenario that Advisors fear most? It is a repeat of the Crash of 1987. MarketCycle would like to remind everyone that this “crash” caused investors to lose only 9 months worth of profits and they made these profits back within the next 13 months. A repeat of this is not the thing to fear. But what is the thing that we should all fear? Our own fears… our innate emotions and cognitive biases that force us to constantly make poor decisions, to do the wrong thing at the wrong time and to have clouded vision!

DALBAR reports that individual investors continue to earn ¼ of the annual gains of buy & hold in the S&P-500 because of repeatedly buying high and selling low… and this subpar gain is compared to buy & hold, which is itself a subpar technique.

NAAIM: “Buy & hold is a very high risk strategy… just look at the drawdowns (losses) that a buy & hold account experiences.”

The truth is that buy & hold is a myth:

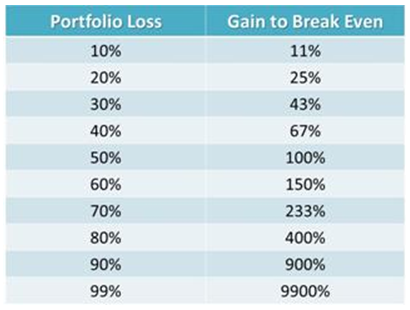

And, normal market gyrations should be tolerated, but bigger losses must be avoided because they are difficult from which to recover:

If one’s portfolio gains 15% per year for three consecutive years and then loses 15% in the fourth year, then the total return for the four year period would be only slightly higher than 6% per year. It is extremely important to avoid losses over the longer-term.

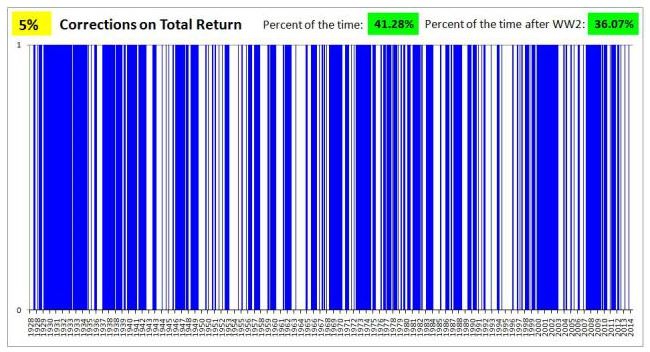

But investors need to get used to normal gyrations in the shorter-term. The percent of time that the stock market experienced a 5% correction (between the years of 1928 and 2014) is shaded in blue:

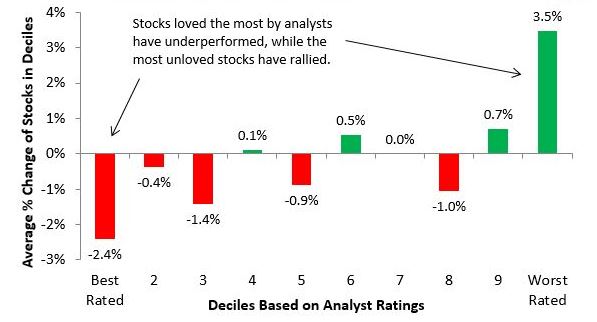

Individual stock picking is also problematic. 93% of professional stock traders believe that they are better than average (which is impossible) and yet only (a rotating) 4% beat the S&P-500 each year; the professional stock analysts that traders get their “stock-picking” information from have an extremely low accuracy rate. On any given day, tens of millions of traders are buying and selling the same 4000 U.S. stocks… back and forth, back and forth and back and forth. Millions of these traders are attempting to beat Warren Buffett by placing lines and squiggles on a price chart. A long-term holding of a diversified ETF portfolio (containing trending assets) may be the best choice for the 96%.

John Bogle: “Do not look for the needle in the haystack, just buy the haystack!”

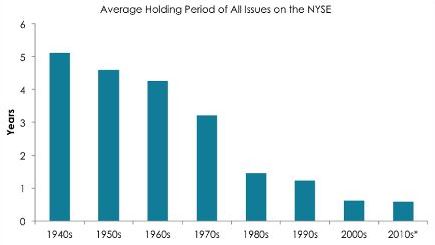

The fact that “reversion toward the mean” is forever and always in force tells us that one should avoid any outperforming esoteric ETFs and mutual funds because they will soon be laggards. (The majority of actively managed 5-STAR rated mutual funds are able to hold that top rating for 12 months and are subsequently rated 1-STAR within 5 years. Mutual funds normally have dramatically higher fees and taxes than do ETFs.) Importantly, now that the “dumb money” has control of the markets via ETFs that they can jump in and out of, long-term holding periods should continue to outperform, offering patient investors a type of time arbitrage.

Ralph Wagoner: “The market is like an excitable dog on a very long leash in New York City, darting randomly in every direction. The dog’s owner, who ultimately determines the primary direction (trend), is walking from Columbus Circle, through Central Park, to the Metropolitan Museum. At any one moment, there is no predicting which way the pooch will lurch. But in the long run, you know he’s heading northeast at an average speed of three miles per hour. What is astonishing is that almost all of the market players, big and small, seem to have their eye on the dog, and not the owner.”

REFERRALS: When an existing member refers a colleague that goes on to become a new fully paid member (after their free trial period), then the referring member will be mailed a check in the equivalent amount as one month of membership (at your membership level). It is a win-win for all involved.

MarketCycle Wealth Management, LLC is a Registered Investment Advisor. The following is our Privacy Policy and all clients and members must read this yearly. ADVs are available upon request and are updated each Spring:

PRIVACY POLICY: “Investment Advisors, like all providers of personal financial services, are now required by law to inform their clients of their policies regarding privacy of client information. Investment advisors have been and continue to be bound by professional standards of confidentiality that are even more stringent than those required by law. Therefore, we always protect your right to privacy. We collect nonpublic personal information about you that is either provided to us by you or obtained by us with your authorization. For current and former clients, we do not disclose any nonpublic personal information obtained in the course of our practice except as required or permitted by law. Permitted disclosures include, for instance, providing information to our employees and, in limited situations, to unrelated third parties who need to know that information to assist us in providing services to you. In all such situations, we stress the confidential nature of the information being shared. We retain records relating to professional services that we provide so that we are better able to assist you with your professional needs and in some cases, to comply with professional guidelines. In order to guard your nonpublic personal information, we maintain physical, electronic and procedural safeguards that comply with our professional standards. Please contact us using the tab above if you have any questions, because your privacy, our professional ethics and the ability to provide you with quality financial services are very important to us.”